If you have spent more than perhaps 30 seconds on entrepreneu-bro twitter/youtube/tiktok you have probably heard of a concept called Ikigai.

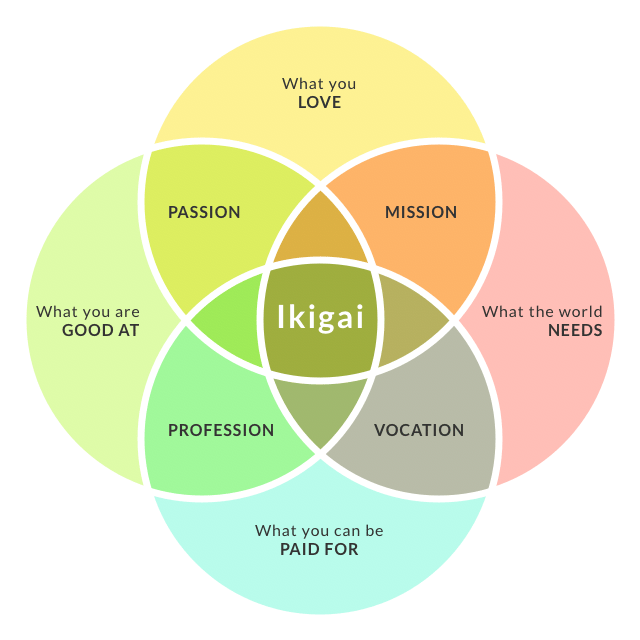

And if you haven’t heard of this concept, here is an image explaining it more efficiently than I ever could:

Ikigai

I am currently 22 years old. For the first time in my life, I think I have found an idea that actually fits into my Ikigai.

Allow me to explain.

What I love:

The Oxford English dictionary defines an anomaly as something that deviates from what is standard, normal, or expected.

For as long as I can remember, I have been drawn to anomalies like a moth to a flame.

Specifically, I have grown obsessed with anomalies that might lead to growth for myself, my wallet, and most importantly, the world.

I believe that the world operates through a series of transactions, thus the best way to find anomalies is to study transactions.

At 15, this study of transactions manifested through studying the volume of mentions of penny stocks across different subreddits. I would buy the most talked about stocks, not because of the underlying value of the equities but because I knew that it was an anomaly for these small cap stocks to garner so much attention. By doing this I turned $80 into over $1000 and bought my first laptop.

At 22, this study of transactions manifested through studying search volume. Understanding that, search is the largest database of transaction data in the world. Search reveals what consumers are interested in, possibly before consumers even understand their own interest. It was through this obsession with search volume that I found interest in prediction markets. I found out that I could use my interest in search volume to predict the outcomes of cultural markets.

It was shortly after that I realized the power of prediction markets.

What the world needs:

The largest markets in the world are closed off to the general public. Not in a literal sense, but in a tactical sense.

A Bloomberg terminal costs $30,000 a year. By the time an article is released by the Wall Street Journal the information is already priced in to the market. Quants getting paid 7 figures a year write algorithms to syphon any and all repetitive alpha.

But, then there are prediction markets.

I believe in the value of prediction markets because they democratize obsession.

Maybe if you are Warren Buffett and basically came out of the womb being obsessed with the Moody’s manual then the stock market is for you. But, for the vast majority of people obsession manifests in a different way.

Do you think you understand movie ratings better than anyone else?

Do you think you understand weather patterns than anyone else?

Do you think you understand the voting habits of a specific country better than anyone else?

Well, prediction markets allow you to profit from your unique understanding of your life long obsession.

Robinhood democratized stock trading.

Apple democratized personal computing.

Prediction markets democratize that weird autistic thing you’ve been into since you were a kid.

What I am good at:

I’ve always been really into tech. I’ve loved computers for as long as I can remember and studied business and computer science in college. With that being said, I do not believe I am a 51st percentile programmer. I do not believe I have the technical capability or business acumen to build a prediction platform that could go head to head with the top dogs of this industry.

But, although it might not appear on this page, I believe I am a 51st percentile writer. I am no Robert Frost or Ernest Hemingway, but I believe I am at least above the median writing capability of the average citizen of the world. On top of that, I believe I have an 85th percentile work ethic.

This combination of writing ability and work ethic leads me to believe that, with persistent practice and effort. I can build a successful newsletter.

What I can be paid for:

Now, here is the real kicker. What can I be paid for?

Well, if I grow this newsletter to 1 subscriber, and continue growing at a rate of 5% per month, with the growth rate also growing by 5% per month I would hit 1 million subscribers in 5 years.

A newsletter with a million subscribers in a finance-adjacent field could pretty simply hit 7 figures in profit/year and exit for 8 figures. Not to mention the content brand around it. Think, the Hustle, Morning Brew, the Milk Road.

What is left to do:

Put in that work baby.

And, get at least a little bit lucky.

But mostly, work smart and hard.

Catch you with some market updates tomorrow.

WHALE WATCH:

Unfortunately, no whale moves today. Guess rich guys don’t trade on Wednesdays?

MARKET MAKER: 5 unique markets (i.e. non-repeating) that were added to Kalshi over the past 24 hours

How many streams will the top song on Spotify's Daily Top Songs Global have tomorrow?

Who will be the Republican nominee for ND-AL?

Who will be the Democratic nominee for NJ-07?

2nd place in the NJ-11 special election Democratic primary?

How many views will the #1 Movie on Netflix have this week?

Hope you have a beautiful day.

Hope you find your Ikigai.

Best,

Javier

(written with ❤️ and ☕️ in Nashville, TN, USA @ 7:28PM CST)